This Sunday started the Panamaleaks, resulting in a torrent of news scandals involving banks, politicians and countless number of celebrities around the world. From the Nordic perspective, the biggest news was that the Nordea bank had set up nearly 400 offshore companies for its clients to the secrecy jurisdictions Panama and British Virgin Islands.

According to the Danish Politiken newspaper, Panamaleaks involved 542 banks, out of which Nordea ranked 11th in terms of the number of shell companies it has helped to set up.

In year 2015, Nordea had 393 employees in Luxembourg, representing a growth of 20 employees from the previous years. It made 211 million of profits with this work force. As a comparison, Nordea employed 6946 people in Finland with 1535 million of profits in 2015. This information is available at Nordea’s annual report, thanks to the long-term civil society campaigning that required large EU banks to published mandatory country-by-country reports on some of their key financials.

While there can be many reasons for Nordea’s high profits in Luxembourg, they most certainly raise some interesting questions. Moreover, they reflect the findings by the development NGO Oxfam that published its analysis on the French banks use of tax haven subsidiaries just last month.

Curiously, Nordea said in its response to the scandal that the automatic exchange of information will provide the information to all interested parties.

However, in reality, Panama first stated as a reaction to the automatic exchange of information that “none of these supposed international ‘standards’ meets the legal requirements of being international law”. After this, Panama said it will comply with the standard, but only after introducing six criteria that it would require from other countries. This led the OECD to remove Panama from its list of complying jurisdictions.

In other words, Nordea’s claims on the information exchange in Panama are a mere lip service for transparency. One can only wonder how this goes together with the bank’s guidelines on ethics and integrity. In these guidelines Nordea maintains that “Compliance risk is the risk of business not being conducted according to legal and regulatory requirements, market standards and business ethics. Proper compliance is one of the main guardians of the conscience and ethics of a financial services business.”

Another curious document is Nordea’s brochure for its trust services in the Isle of Man. This pdf was removed from Nordea’s Danish site after I wrote about it in Finnish on late Sunday, but similar material is still available in the bank’s US site (although I assume it will be removed soon after this post).

In the brochure, Nordea highlights anonymity and confidentiality as one key feature of its trusts. I have my doubts on whether this material is up-to-date, but I have not managed to find any comment from Nordea on this for the time being.

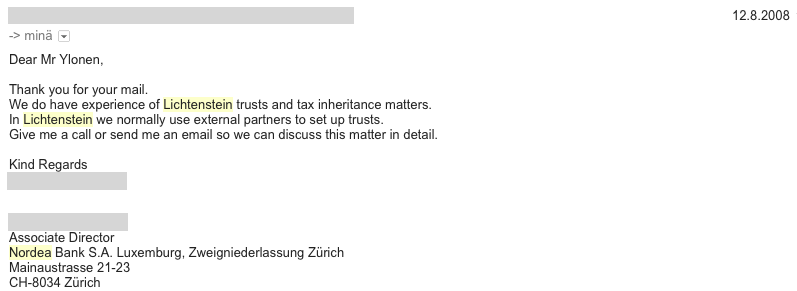

Finally, it would be interesting to hear whether Nordea still helps setting up trusts in Liechtenstein. They did this in 2008, when I asked about it in an email:

All in all, Panamaleaks and these material underline that we need binding, ambitious EU-level policies to tackle tax avoidance and tax evasion.